Tax Calculation Concepts and Procedures

Interactive Video

•

Mathematics

•

9th - 10th Grade

•

Hard

Thomas White

FREE Resource

Read more

8 questions

Show all answers

1.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

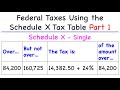

What is the first step in calculating federal tax based on taxable income?

Identify the correct tax table

Calculate the total income

Determine the tax rate

Subtract deductions

2.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

In the tax table, what does the 'over but not over' column indicate?

The range of taxable income

The total tax amount

The deductions available

The tax rate

3.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

For a taxable income of $92,000, which row should be used in the tax table?

Row 2

Row 3

Row 4

Row 1

4.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

How is the tax calculated for a taxable income of $92,000?

By multiplying the income by a fixed rate

By adding a base tax amount and a percentage of the income over a certain threshold

By subtracting deductions from the income

By using a flat tax rate

5.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

What is the importance of using parentheses in a calculator for tax calculations?

To avoid errors in subtraction

To separate different calculations

To make the calculation look neat

To ensure the correct order of operations

6.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

In a new scenario, what is the taxable income considered?

$84,200

$92,000

$510,300

$926,000

7.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

For a taxable income of $926,000, which row should be used in the tax table?

Row 8

Row 7

Row 6

Row 5

8.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

How should you handle taxable income that falls exactly on an interval boundary?

Use the row where the number first appears

Use the row where the number last appears

Use the row with the higher tax rate

Use the row with the lower tax rate

Similar Resources on Wayground

11 questions

Federal Income Tax Calculations

Interactive video

•

9th - 12th Grade

11 questions

Understanding the 1040 Form for 2023

Interactive video

•

9th - 10th Grade

11 questions

Understanding Tax Deductions and Credits

Interactive video

•

9th - 12th Grade

6 questions

Understanding Income Inequality

Interactive video

•

9th - 10th Grade

11 questions

Understanding Taxes on Social Security Benefits

Interactive video

•

9th - 10th Grade

11 questions

Retirement Planning Updates for 2025

Interactive video

•

9th - 10th Grade

6 questions

Understanding Tax-Loss Harvesting

Interactive video

•

9th - 10th Grade

6 questions

Understanding Tax Deductions and Credits

Interactive video

•

9th - 10th Grade

Popular Resources on Wayground

10 questions

Video Games

Quiz

•

6th - 12th Grade

10 questions

Lab Safety Procedures and Guidelines

Interactive video

•

6th - 10th Grade

25 questions

Multiplication Facts

Quiz

•

5th Grade

10 questions

UPDATED FOREST Kindness 9-22

Lesson

•

9th - 12th Grade

22 questions

Adding Integers

Quiz

•

6th Grade

15 questions

Subtracting Integers

Quiz

•

7th Grade

20 questions

US Constitution Quiz

Quiz

•

11th Grade

10 questions

Exploring Digital Citizenship Essentials

Interactive video

•

6th - 10th Grade

Discover more resources for Mathematics

15 questions

ACT Math Practice Test

Quiz

•

9th - 12th Grade

12 questions

Graphing Inequalities on a Number Line

Quiz

•

9th Grade

15 questions

Two Step Equations

Quiz

•

9th Grade

15 questions

Combining Like Terms and Distributive Property

Quiz

•

9th Grade

12 questions

Absolute Value Equations

Quiz

•

9th Grade

8 questions

ACT Math Strategies

Lesson

•

9th Grade

10 questions

Solving Absolute Value Equations

Quiz

•

9th Grade

16 questions

Parallel Lines Cut by a Transversal

Lesson

•

9th - 10th Grade